Temporary changes to how BIK is charged on company cars and vans

Recently, the Irish government announced temporary changes to how Benefit-in-Kind (BIK) is charged on company cars after complaints that reforms introduced at the start of the year were leading to big increases in tax bills for those driving them.

What are the temporary changes to BIK charges on company cars?

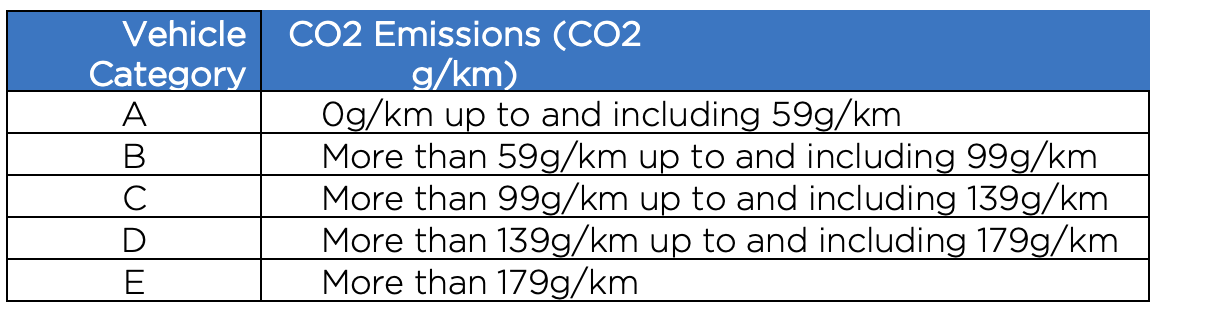

The Original Market Value (OMV) of cars in Category A-D, will be reduced by €10,000 which will consequently reduce the BIK charge. It won't, however, apply to the E category of most polluting vehicles.

This treatment will also apply to all vans and electric vehicles. For electric vehicles, the OMV deduction of €10,000 will be in addition to the existing relief of €35,000 that is currently available for EVs, meaning that the total relief for 2023 will be €45,000.

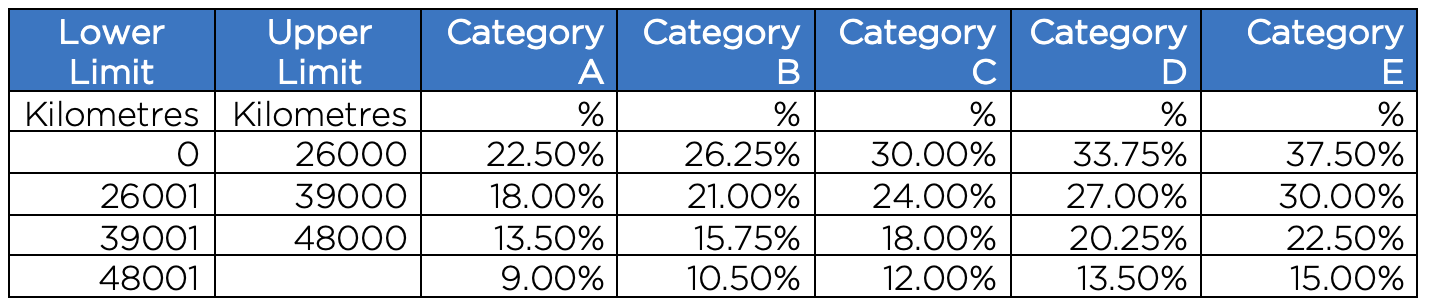

Table 1 – The amount of business mileage and CO2 emission category (new temporary changes)

Table 1 - CO2 emissions table

Table 2 - Business Mileage Categories

What does this mean for businesses and employees in Ireland?

It is important for employers to take note of the changes in BIK for company vehicles and incorporate them in the upcoming payroll submission. The changes have been effective since 1st January 2023 and may require a one-time adjustment for any excess BIK that was applied from that date. If a tax refund is due for the excess BIK and the employee is on a cumulative basis of assessment, the refund should be processed through the payroll function.

In conclusion, the temporary changes to BIK charges on company cars announced by the Irish government are intended to provide some relief to businesses and employees. While the changes are temporary, they could have a significant impact on the amount of taxes that employees pay on their company cars. Businesses and employees should be aware of these changes and plan accordingly.

Get in Touch

If you require any additional information based on the details outlined in this update, please get in contact a member of our tax team. We'd be happy to hear from you!