Revised Motor Travel Rates

The Department of Public Expenditure and Reform has announced changes to the motor mileage rates for civil service. The new rates come into effect from 1st September 2022.

Motoring expenses

- The rates and mileage bands in place since 1st April 2017 have been reviewed in the context of current motoring input costs.

- It also takes account of the commitments by Government in relation to the Climate Action Plan 2021 (CAP 21) and for the first time a dedicated rate is introduced for Electric Vehicles (EVs).

- It should be noted that in support of the Climate Action Plan 2021 (CAP 21) and in the interests of administrative efficiency, it is the Department’s intention to move at the time of the next review to a new single rate for all cars regardless of engine type.

- As a first step in the transition to a single rate, the EV rate is being increased and is being set at the same rate as that applying to vehicles in the middle category of 1,201 to 1,500.

- Hybrid vehicles will continue to be recouped at the equivalent Internal Combustion Engine (ICE) rates and should not be claimed in the EV category.

- The rates listed in the Appendix to this Circular will be fixed for a period of three years. However, in the event of any future downturn in input costs, the rates may be adjusted to reflect the changing costs.

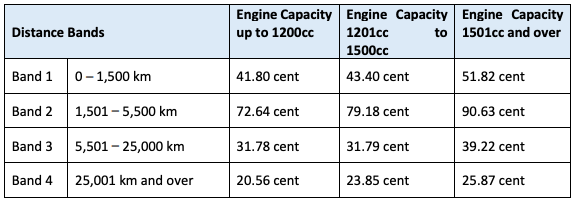

Motor Travel Rates per kilometre

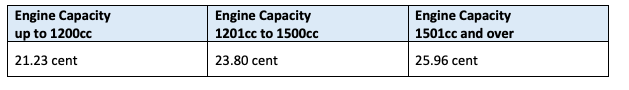

Reduced Motor Travel Rates per kilometre

For a full summary of the Revised Motor Travel Rates, please click here.

If you require any additional information based on the details outlined in this update, please get in contact a member of our tax team. We'd be happy to hear from you.