Payroll FAQ from Budget 2023

2023 Budget Payroll Updates

Welcome to our concise overview of the payroll updates introduced in Budget 2023. As an employer, it's crucial to stay abreast of the latest changes to tax rates, Universal Social Charge (USC), minimum wage, and more. Our comprehensive summary will ensure you are well-informed, enabling you to navigate these updates seamlessly and maintain compliance.

Pay As You Earn (PAYE)

- There is no change to tax rates for 2023 - the standard rate remains at 20% and the higher rate at 40%

- The Standard Rate Cut Off Point (SRCOP) has been increased by €3,200, from €36,800 to €40,000

- The Personal Tax Credit has been increased by €75 from €1,700 to €1,775

- The Employee Tax Credit has been increased by €75 from €1,700 to €1,775

Earned Income Tax Credit

- The Earned Income Credit has been increased by €75 from €1,700 to €1,775

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- The 2% USC rate band has been increased by €1,625, from €21,295 to €22,920

- There are no changes to the rates of USC

- For 2023, USC applies at the following rates for those earning in excess of €13,000

- Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

- The emergency rate of USC remains at 8%.

- Non-PAYE income in excess of €100,000 continues to be subject to USC at 11%.

USC Rates & Bands 2023

- €0 - €12,012 @ 0.5%

- €12,013 - €22920 @ 2%

-€22,921 - €70,044 @4.5%

-€70,045 + @8%

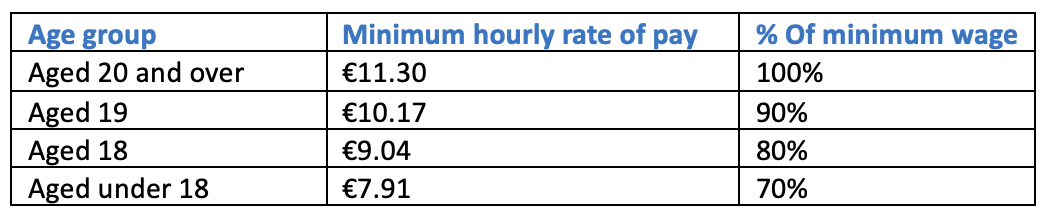

National Minimum Wage

- The National Minimum Wage has increased by €0.80c from €10.50 to €11.30 per hour from January 1st 2023.

Pay Related Social Insurance (PRSI)

- The weekly threshold for the higher rate of employer PRSI has increased to €441 from €410 - this is in line with the increase in the National Minimum Wage.

Social Welfare

- There is a €12 increase in all weekly Social Welfare payments with effect from January 2023. The maximum personal rate of Illness Benefit will be increased to €220 per week. Maternity Benefit, Parent’s Benefit and Paternity Benefit will be increased to €262 per week.

Changes to BIK on Company Cars and Vans

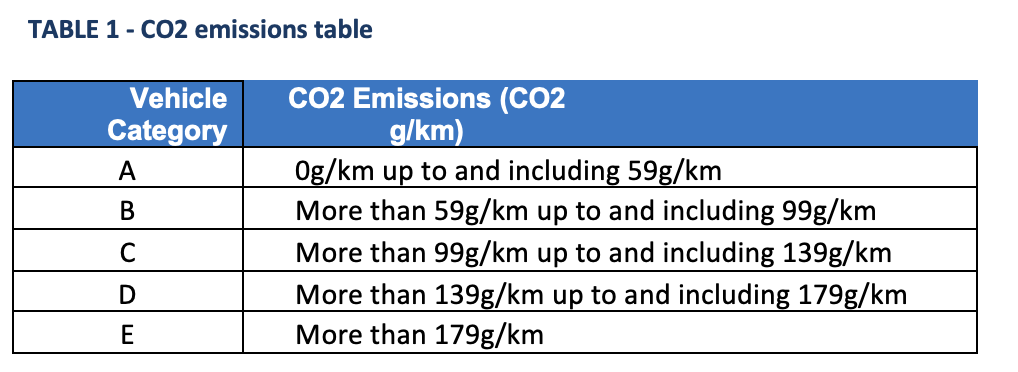

Under the present system, applied from 1st January 2023, vehicles are divided into 5 different bands from A to E. Band A will apply to cars with the lowest CO2 emissions while Band E will apply to the cars with the highest level of CO2. The emissions rating for a car can be found at item J5 on the vehicle’s Registration Certificate.

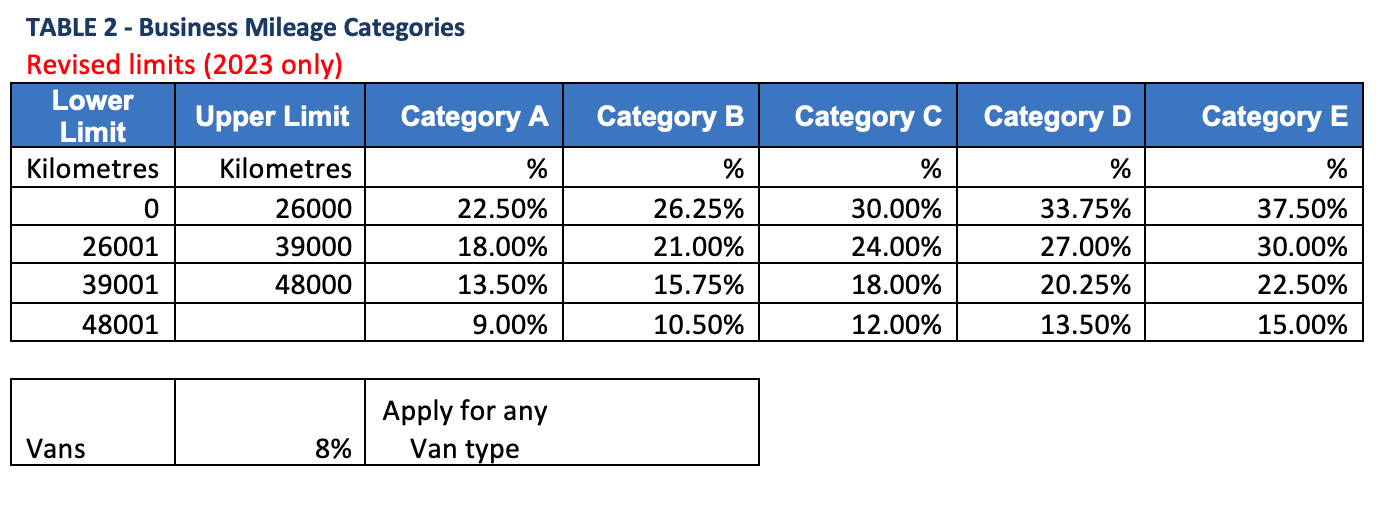

To calculate the annual BIK, the employers should first find out the vehicle’s OMV (Original Market Value), their CO2 emission category (Table 1) and also provide the business mileage per year.

With this information, the employer can then identify the percentage due for the BIK (Table 2).

For Company Vans the CO2 emission and Kms are ignored, and the BIK should be applied at 8% of the OMV.

Extension of BIK Exemption for Electric Vehicles

- The BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced to €35,000 for 2023, €24,000 for 2024 and €10,000 for 2025.

Temporary Reduction in OMV for 2023

On 7th March 2023, the Government announced a temporary measure which allows the OMV on a company car which falls into category A, B, C or D and company Vans, to be reduced by €10,000 before calculating the BIK. The relief does not apply to company cars which fall into category E. This temporary reduction in the OMV is in addition to the existing OMV reduction to €35,000 for electric cars and vans, which means that the OMV of electric cars and vans will be €45,000 (Max) in total for 2023.

If you have any further questions or need additional guidance, don't hesitate to reach out to our team. We are here to support you in navigating the complex landscape of payroll management.